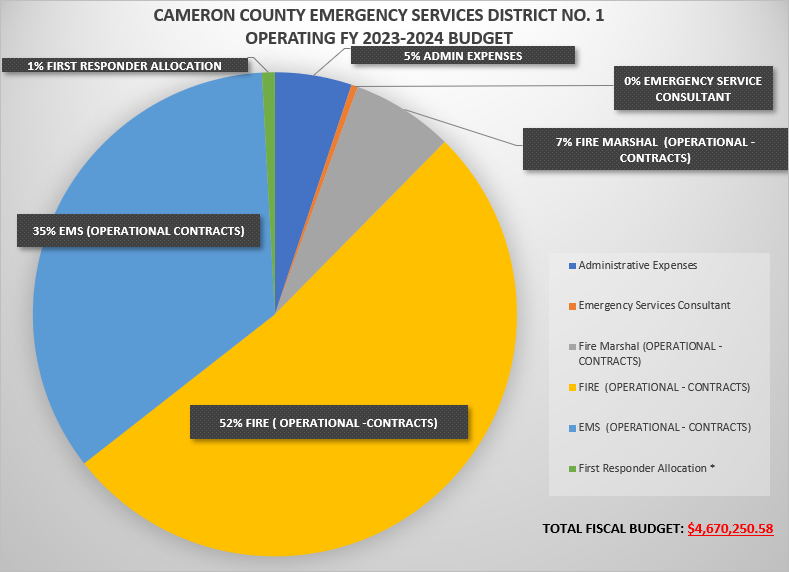

Funding and Budget

ESDs are funded by property tax, sales tax, and/or fees. The CCESD is funded only by an Ad Valorem Property Tax Rate of .10 cents per valuation. The CCESD holds schedule meetings and public hearings on budget and tax rate to comply with truth-in-taxation requirements. A budget is adopted by September 30th and before adopting a tax rate. The tax rate is adopted by September 30th or within 60 days after tax roll certification.

Budget Comparison

| FY 2022-2023 | FY 2023-2024 | Net Change | ||

|---|---|---|---|---|

| Administrative Expenses | $219,755.00 | $239,809.75 | Increase 9.13% | $20,054.75 |

| Emeregency Service Consultant | $15,000.00 | $20,000.00 | Increase 33.3% | $5,000.00 |

| Fire Marshal (Operational -Contracts) | $314,971.31 | $318,707.75 | Increase 1.19% | $3,736.44 |

| Fire (Operational - Contracts) | $2,254,026.44 | $2,431,039.85 | Increase 7.85% | $177,013.41 |

| EMS (Operational - Contracts) | $1,502,684.27 | $1,620,693.23 | Increase 7.85% | $118,008.96 |

| First Responder Allocation (Implemented 2019-2020) | $40,000.00 | $40,000.00 | 0.00 | 0.00 |

| Total Budget | $4,346,437.02 | $4,670,250.58 | Increase 7.45 % | $323,813.56 |

Cameron County Emergency Services District No.1 Truth in Taxation 3-year Summary

| Fiscal Year | 2021-2022 | 2022-2023 | 2023-2024 | Net Change (Last Budget and Current) | |

|---|---|---|---|---|---|

| Total Budget | $4,106,347.95 | $4,346,437.02 | $4,670,250.58 | Increase 7.45 % | $323,813.56 |

| Property Tax Revenue for (M&O) | $4,106,347.95 | $4,346,437.02 | $4,670,250.58 | Increase 7.45 % | $323,813.56 |

| Perentage of budget funded by Property Tax | 100% | 100% | 100% | 0% | 0% |

| Adoptex Tax Rate | 0.08615 | 0.083067 | 0.073678 | Decrease 11.30% | -0.009389 |

| Adopted Tax for Debt of Service | 0 | 0 | 0 | 0 | 0 |

The Current Tax Rate for Fiscal Year 2023-2024 is $0.073678 /$100 VALUATION.

Cameron County Emergency Services District No.1 ADOPTED A TAX RATE THAT WILL RAISE MORE TAXES FOR MAINTENANCE AND OPERATIONS THAN LAST YEAR’S TAX RATE

2023 Calculation Worksheet

2023 Notice of Public Hearing on Tax Increase

2023 Notice About 2023 Tax Rates

2023 Notice of Public Hearing Notice for ESD Budget

CCESD Audit 2022

2022 Notice of Public Hearing on Tax Rate

Public Hearing Notice for 2022 ESD Budget

2022 Tax Rate Calculation Worksheet

2021 Notice of Tax Rate

Public Hearing Notice for 2021 ESD Budget

CCESD Audit 2021

2020 Tax Rate Calculation Worksheet

Notice of Public Hearing 1102 EMERGENCY SERVICE DISTRICT

2020 Notice of Tax rate

Proposed Budget 2020

The District’s amount of property tax revenue budgeted for maintenance and operations, and the amount of property tax revenue budgeted for debt service. (See Tax Code 26.18 (7) and (8)

2022 – 2023 Property Tax Revenue Budgeted for Maintenance and Operations: $ 4,346,437.05

2022- 2023 Property Tax Revenue Budgeted for Debt Service: $0.00 All of the District’s property tax revenue is allocated for Maintenance and Operations.

2021-2022 Property Tax Revenue Budgeted for Maintenance and Operations: $ 4,106,347.95

2021-2022 Property Tax Revenue Budgeted for Debt Service: $0.00 All of the District’s property tax revenue is allocated for Maintenance and Operations.

2020-2021 Property Tax Revenue Budgeted for Maintenance and Operations: $ 3,696,237

2020-2021 Property Tax Revenue Budgeted for Debt Service: $0.00 All of the District’s property tax revenue is allocated for Maintenance and Operations.

2019-2020 Property Tax Revenue Budgeted for Maintenance and Operations: $ 3,528,207

2019-2020 Property Tax Revenue Budgeted for Debt Service: $0.00 All of the District’s property tax revenue is allocated for Maintenance and Operations.

2018-2019 Property Tax Revenue Budgeted for Maintenance and Operations: $ 3,057,423

2018-2019 Property Tax Revenue Budgeted for Debt Service: $0.00

2017-2018 Property Tax Revenue Budgeted for Maintenance and Operations: $ 3,034,437

2017-2018 Property Tax Revenue Budgeted for Debt Service: $0.00